Special topics

The Africa Centre for Energy Policy (ACEP) has criticized the President Mahama-led government and the Ghana National Petroleum Corporation (GNPC) for not having the interest of Ghanaians at heart in the signing of the doubtful US$7 billion integrated oil and gas development agreement in the Sankofa-Gye-Nyame Fields.

The Africa Centre for Energy Policy (ACEP) has criticized the President Mahama-led government and the Ghana National Petroleum Corporation (GNPC) for not having the interest of Ghanaians at heart in the signing of the doubtful US$7 billion integrated oil and gas development agreement in the Sankofa-Gye-Nyame Fields.

President John DramaniMahama last week announced a controversial Gas deal between GNPC and the Offshore Cape Three Point (OCTP) Partners; ENI Ghana and Vitol Ghana (Contractors) over a US$7 billion integrated oil and gas development in the Sankofa-Gye-Nyame Fields but the agreement seems to be a bad one that will make Ghana lose millions of dollars according to the Africa Centre for Energy Policy(ACEP).

According to ACEP, analysis of the terms and conditions of the Agreements and Term Sheets show that the deal is fraught with badly negotiated terms, and at most serving the interest of the Contractors rather than Ghana’s.

The findings from the analysis show that the government offered over-generous terms to the Contractors just to satisfy Ghana’s thirst for gas supplies. In trying to satisfy the country’s demand for gas, the incentives provided to the Contractors exceeded what pertains in international transactions of similar nature.

ACEP noted that Government’s fiscal support package, which included an exempt debt-to-equity ratio of 2:1 at 7% interest on the commercial loans of the Contractors, would lead to significant revenue losses to the state over the project life of 20 years, since interest expenses are tax deductible. The state must guarantee that at anytime, the free fiscal support to the Contractors remain $125 million to make the initial gas price of $9.8 per mmBtu. This could run into several millions of dollars when gas prices fall. In the event that the contractors source the loans from their affiliates, the gains to the Contractors could increase at Ghana’s expense.

The Government is required under the Security Package and Fiscal Support Agreement to issue five (5) different Sovereign Guarantees estimated at about $1.5 billion in addition to World Bank and IDA guarantees. This situation over-exposes the state to too much risks and demonstrates the lack of INVESTOR confidence in the Ghanaian Government.

It said the plan by GNPC to make an upfront payment in cash to the Contractors or allow the Contractors to over-lift GNPC’s share of oil at the beginning of production of oil, for the purpose of making Gas price of $9.8 per mm Btu viable in not fair .he said although the amount is expected to be recovered at the end of production, the recovery amount does not attract interest charges. This is not consistent with sound financial management.

According to ACEP, Government’s decision to allocate the maximum 55% Net Carried and Participating Interest to GNPC beyond the 15 year period for the capitalization of GNPC as provided in the Petroleum Revenue Management Act 2011 (Act 815) or PRMA violates Section 7.3 of the PRMA and will therefore amount to an illegality.

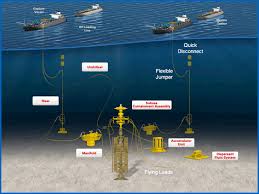

The Agreement covers terms and conditions for the FINANCING of the project by the Contractors and for the sale of the Contractors’ share of gas produced to GNPC. The Sankofa-Gye-Nyame Fields is estimated to hold petroleum reserves of 131 million barrels of crude oil and 1.15 trillion cubic feet of natural gas. The project is in two phases – Phase 1 (Oil) and Phase 2 (Gas). First oil is expected on stream in March 2017 whilst first gas is expected in February 2018.

Daily production of oil will be at 80,000 barrels whilst daily production of gas will average 171 million standard cubic feet over 20 years.

As part of the deal OCTP Petroleum Agreement signed in 2006 (Approved by Parliament). ENI farmed into the Petroleum Agreement in September, 2009.Supplementary Agreement for Submission of OCTP Plan of Development was signed in 2014 and approved by Parliament

Fiscal Support Agreement and Security Package Term Sheet for was signed in December 2014 (Approved by Parliament)

2.0. Sharing of Petroleum

Sharing of petroleum in monetary terms is based on the fiscal regime in the OCTP Petroleum Agreement. The fiscal terms include royalty of 7.5% for oil since the water depth is in excess of 400 mters; gas royalty of 5%, corporate tax of 35%. GNPC has a carried interest of 15%; and additional paid interest of 5%. The working interest of the partners therefore amount to ENI Ghana (44%), Vitol Ghana (35%) and GNPC (20%).

Based on after tax working interest, the contractor group will be entitled to $14.3 billion (56%) of total cash flow over the project life whilst the state is entitled to $11.1 billion (44%). The state take is lower than what pertains to previous contracts. Given that the project is a $7 billion project, the contractors will be making profit of $7billion. This makes the project a profitable one at an OIL PRICE of US$90 per barrel and gas price of US$9.8 per mmBtu.

3.0. Over-generous Concessions by the State

In spite of these gains the company is likely to make from the deal, the Government has further over-exposed the country to too much risk due the decision to buy all the gas produced by the contractor. The exposure takes the form of guarantees and security to keep gas price at $9.8 per mmBtu and to support the Gas Sales Agreement. This is where the real challenge is. The over-generous concessions the Government and GNPC are providing to the Contractors are examined here.

3.1. The Fiscal Support

The Government and GNPC have offered through the Supplementary Agreement to make the initial gas price of $9.8/mmBtu viable by providing a fiscal package to the tune of $250 million. A total of $125 million will be provided by GNPC upfront, whilst the remaining fiscal concessions amounting to another $125 million to be provided by Government will ran over the project life.

Source: Kwabena Adu Koranteng, The New Crusading Guide